Just because you aren’t a billionaire doesn’t mean you can’t use the Buy, Borrow, Die Strategy too.

This article provides an overview of the tax strategies used by the ultra-wealthy. Read more to find out how Jeff Bezos, Elon Musk, and other billionaires managed to amass huge amounts of wealth while paying little to no tax.

In the summer of 2021, ProPublica published an article discussing the strategy many billionaires use to avoid paying taxes. Even though these individuals are experiencing vast increases in their wealth year after year, they still manage to set up their investments in such a way that they pay little to no taxes.

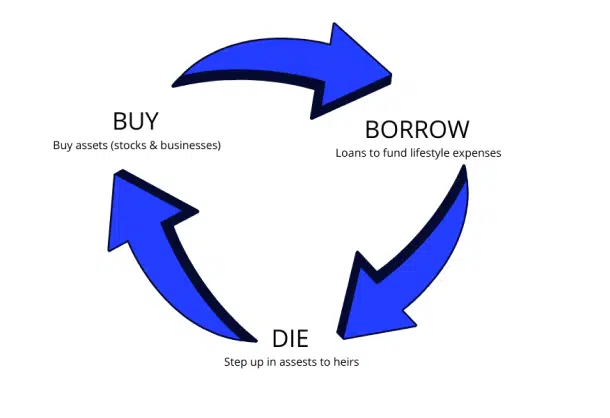

The Buy, Borrow, Die Strategy is not new to tax professionals. This approach has been used for years to develop strategies for accumulating vast sums of wealth and passing that wealth down to heirs without paying a big chunk to the IRS.

Learn how high net worth individuals are implementing variations of the Buy, Borrow, Die Strategy into their investment strategies.

Is the Buy, Borrow, Die Strategy Legal?

Let’s start by addressing a very common misconception. Is this strategy legal? YES! It is 100% legal if done properly.

Contrary to what you might hear on MSNBC, the Buy, Borrow, Die Strategy is perfectly legal.

Many have the false belief that these billionaires are breaking the law. But the truth is, these strategies are blessed in the tax code and available to everyone, even you.

Kudos to you for reading this article and learning more about tax planning opportunities. Many fail to appreciate that you don’t have to be a mega millionaire to implement the Buy, Borrow, Die Strategy. All you need is a little cash to work with and a basic understanding of how the tax laws work.

The “Buy, Borrow, Die” Strategy was made famous by a ProPublica report that provided insight into the tax situation for many of America’s ultra wealthy.

What is the Buy, Borrow, Die Strategy?

So what is the Buy, Borrow, Die Strategy and how does it work? We’ll walk you through a few basic examples to help you understand how to implement the strategy.

This isn’t rocket science. Many people are already doing some variation of this planning without even knowing it.

Here is a good graphic that helps you visualize how the cycle works.

Tax Planning HQ is not in the business of providing investment advice. Nothing contained in this article or on this website constitutes investment advice. We encourage you to educate yourself and work with qualified professionals and advisors before making any investment decisions.

Taxable Gains

To understand how this strategy works, it is important to understand that you pay tax on the appreciation in an asset you hold. As a basic matter, the appreciation in an asset is equal to the amount you receive when you sell the asset less the amount you paid for the asset.

Taxable Gain = Sales Price – Amount Paid for the Asset

The amount paid for an asset is commonly referred to are your “basis” in the asset. In some cases, you are required to make adjustments to your basis which may cause your basis to be more or less than the amount you originally paid.

How the Buy, Borrow, Die Strategy Works

Once you understand how the strategy works, it is really quite simple. There are just a few steps to implementing this strategy yourself.

First you buy an asset. Then you borrow money from a bank or other third-party lender against that asset. Lastly you die without ever having sold that asset.

The strategy could really be renamed “Buy, Hold, Borrow, Die” because the key requirement for it to work is to hold the asset throughout your life without ever selling any shares and recognizing the gains for tax purposes.

Let’s explore how each step works in more detail.

1. Buy

Buy an asset or start a company

Example: Jeff Bezos starts Amazon and the value of his shares in Amazon increases over time.

When you own an asset, you are not required to pay any tax unless you receive income from the asset or sell the asset and recognize a gain. When Bezos started Amazon, the shares were virtually worthless. Over time, as Amazon grew, the value of those shares came to be worth billions of dollars. However, as long as Amazon does not pay a dividend to shareholders (tech companies rarely if ever pay material dividends) and Bezos does not sell any of his shares, he will not owe any tax on the value of those shares.

2. Borrow

Take out loans against your assets to fund expenses

Example: Bezos gets a loan from a bank to fund his lifestyle costs and uses his shares of Amazon as collateral for the loan.

Taking out a loan with shares of stock as collateral on that loan is a way to have access to the value of the shares without having to pay any tax. As stated before, if you do not sell the asset, you will not pay any tax on the appreciation in the shares. You can use the cash from the loan to fund your living expenses over time. This can prevent you from having to sell any shares to fund your cost of living.

The loan proceeds are required to be paid back to the lender over time. Therefore, you do not owe any tax when you receive the cash from the loan. If structured properly, you may also receive a tax deduction for interest paid on the loan.

3. Die

Heirs receive a step-up in basis in the assets inherited

Example: Bezos’s heirs will receive a step-up in basis in the Amazon shares inherited upon his death.

Under current law, heirs receive what is called a “step-up” in basis in assets received from a decedent’s estate. Instead of having the same basis as the decedent, the heir is able to step-up their basis in the asset to the fair market value on the date of death. This means that when Bezos dies, his heirs will have a basis equal to the fair market value of Amazon’s shares on his date of death. If those shares are immediately sold, the heir should recognize no gain as the amount received for the shares (FMV) will be equal to their tax basis (also FMV).

There are also other strategies and estate planning techniques for passing down assets to future generations without incurring estate tax.

4. Repeat

Heirs liquidate appreciated asset and repeat the same cycle

After getting the benefit of a step-up in basis, heirs can sell the assets and receive the cash while paying no tax. This allows them to then repeat the same strategy by starting a new business or buying new shares of stock. The cycle can be repeated indefinitely allowing families to generate massive amounts of wealth and pass that wealth down to their heirs tax-free.

Notably, there has been some recent discussion about eliminating the benefit of the step-up in basis. However, to date, this has not received enough support from Congress and would likely face significant pushback from moderate Democrats and Conservatives.

The Catch → They Do Actually Pay Some Tax

Most of the billionaires covered in the report earned the bulk of their wealth by starting companies. Those companies were later taken public and are formed as C Corporations. C Corporations pay a corporate level tax on net income each year (at a current rate of 21%). The individual owner will not pay any personal taxes unless they receive a dividend from the company or sell their shares.

The often less-discussed result of this is that for any billionaires owning shares in a C Corporation, they are in effect paying tax by way of the reduction of their allocable share of value of the company for any corporate tax paid.

For example, any tax paid by Amazon is going to have an impact on the value of the company. This will have an indirect impact on the value of Jeff Bezos’s shares in Amazon. Therefore, even though Jeff Bezos may not pay personal income tax on the billions of dollars of net worth he has in Amazon shares, he is still technically impacted by the corporate tax paid by the company.

Benefits of Using the Strategy

A common misconception about the strategy is that it is only used to avoid tax from selling an asset while providing you with liquidity. This is just the tip of the iceberg!

The Buy, Borrow, Die Strategy has a number of benefits.

Let’s start with the most well-understood advantages.

1. Avoid paying tax on appreciation in value of asset

The most obvious and best understood benefit is that you can avoid paying tax on the appreciation in the value of the asset. This is because there is no realization event.

You don’t have to pay tax because you didn’t sell anything. Because you didn’t sell anything, you didn’t recognize any gain (at least in the eyes of the IRS).

2. Have access to liquidity

Even though you don’t sell the asset, you can still cash out the investment so to speak. This is done by borrowing cash against the asset.

This one works in tandem with number 1 above. You get access to cash that was generated from the asset appreciating in value without having to pay any tax on the gain.

Jeff Bezos might be a billionaire, but a lot of his wealth is tied up in Amazon stock. He doesn’t have billions of dollars of cash on hand to spend as he pleases. That means if he wants to buy a $100M yacht for example, he either needs to sell a ton of Amazon shares or take out a loan against them.

3. Still participate in the upside of investment

Don’t forget that because you didn’t sell the asset, you will still get the benefit of any further increase in value of the asset. This is because you still own the asset.

When you combine this with number 2, the result is that you get to access liquidity from the asset while still benefiting from any upside gains that happen in the future. When you take this fact into account, the strategy is a no-brainer!

4. Double dip with the same money

A dirty secret the wealthy don’t often tell you is that you can invest the same money twice. In some cases, you can even invest the same money more than twice.

If you borrow against one asset, there is nothing stopping you from investing that borrowed money into a second asset. You could theoretically repeat this process indefinitely. However, no sane person would do this unless they were prepared to lose everything and find themselves in bankruptcy court.

This approach allows you to be your own bank. Let’s say you want to start a new business. Instead of getting a loan from a bank, you could lend yourself money by taking a margin loan against your public equities. In effect, you are both the borrower and the lender.

CAUTION

Be very careful here! Investing the same money twice into correlated assets can be extremely risky!

5. Diversification of investments

Cashing out your investment through a loan allows you to take some chips off the table. You can reinvest that money into an uncorrelated asset and start to diversify your investments by using the approach mentioned above.

6. Asset protection

Asset protection isn’t as sexy as the other benefits mentioned because it doesn’t make you more money. But what also isn’t sexy is losing all your money.

When you borrow against an asset, the lender usually has senior priority for that asset. This makes debt a great tool for asset protection. Using debt also makes you an unattractive person to sue.

You might have $1M worth of rental properties. But if you only have 10% of equity in the properties and have a $900,000 mortgage, that limits the amount a potential plaintiff could recover from you. They can sue you for $1M all day long. But if you are forced to sell the house, the bank gets their $900,000 first, leaving the plaintiff with only $100,000.

As a practical matter, having a large amount of debt outstanding on your assets makes attorneys less eager to take a case against you because they know 1. the amount they can recover is limited and 2. the case will be a nightmare to litigate.

Practical Ways to Use the Buy, Borrow, Die Strategy

As a basic matter, you can use the Buy, Borrow, Die Strategy if you own an asset and can borrow against that asset.

There are a number of different ways you can use this approach. The table below provides a good summary of the most common assets and the corresponding forms of debt typically used with those assets as collateral. We discuss each of these in more detail below.

| Asset/Collateral for Debt | Common Form of Leverage Used |

| Public securities (ex. Apple shares), mutual funds, ETFs, index funds | SBLOC or margin loan |

| Bond portfolio | SBLOC or margin loan |

| Business you started or acquired | Bank or other external financing |

| *Primary residence | Mortgage or HELOC |

| Rental properties | Mortgage |

This list is not exhaustive of all the approaches available. Any asset that you can find someone to lend you money against may work.

1. SBLOC or margin loan for public equities

Brokerage companies where you trade public equities often allow you to take out cash with those stocks as collateral for the loan. So in essence you are borrowing money from a bank with your shares pledged as collateral on that loan. In the event you are unable to pay the money borrowed back, the bank can take control over your securities.

These loans are usually referred to as a securities-based line of credit (SBLOC) or margin loan. This is not to be confused with buying shares on margin which is an unrelated concept.

This approach works with shares of public companies, index funds, mutual funds, and exchange traded funds (ETFs).

A common example: let’s say you have a portfolio of public stocks with a value of $1M. You borrow $300,000 from the brokerage firm. If for some reason you are unable to pay that $300,000 loan back, the bank can sell $300,000 of your shares and get their money back.

The amount that may be borrowed is commonly equal to 50% or 75% of the value of your portfolio. However, it is usually not advisable to borrow the max amount because of the likelihood of experiencing a margin call. We discuss margin calls in more detail below.

You pay interest on the amount you borrow. Interest rates may be either fixed or variable. Because the collateral (in this case public equities) is highly liquid and your shares are in the custody of the lender (the brokerage firm), the interest rates charged should be low, making this an attractive way to implement the Buy, Borrow, Die Strategy.

Make sure you shop around for the lowest rates. The difference in interest rates charged can vary significantly. The larger brokerage firms often charge the highest rates.

2. SBLOC or margin loan for bonds

A similar strategy may be used if you hold a portfolio of bonds. In some cases, the amount you can borrow will be higher (depending on the type of bonds) because these assets are commonly viewed as less risky than stocks.

A potential advantage of using bonds as collateral is that they are typically less volatile than public stocks or other assets. Therefore, you may have more predictability around the total amount you can safely borrow at any given time.

3. Loan against a business

If you are Elon Musk, your business loan could be a SBLOC or margin loan because Tesla is a public company. However, for those of us who own private companies, those options are not available.

Nonetheless, you may still be able to use the strategy with your business. If you are able to obtain external financing or a business loan, this approach will work.

Banks may be willing to lend you money with your business assets as collateral. In some cases, you could take on financing from institutional investors. Perhaps even a friend or family member is willing to give you a loan.

Admittedly, this strategy may only work for larger businesses. Companies with valuations under $10M may have difficulties finding anyone willing to lend them money. However, if you can get a business loan, tapping into that available leverage might be a good idea.

Interest rates on these types of loans will generally be higher than the rates for real estate or public stocks.

4. Mortgage or HELOC for primary residence

This one is easy. We all know that we can usually get a mortgage on our home. However, many people fail to take full advantage of this form of financing.

Those who have a good understanding of building wealth and tax mitigation strategies will understand the benefits of minimizing the amount of equity you have in your home.

Interest rates on mortgages are often low given that the value of real estate is relatively stable. This is another advantage to considering having a large mortgage on your primary residence.

Another common way to borrow against your primary residence is using what is called a home equity line of credit (HELOC).

*Yes, we know a primary residence is not an asset. Rather, it is actually a liability. However, this is the one exception to the rule that only assets may be used due to the fact that you can usually get a mortgage on your home at low interest rates.

5. Mortgage for rental properties

If you own rental properties, you should also be able to borrow against those properties in a similar fashion as your primary residence.

What Are the Risks?

Now that you understand what the Buy, Borrow, Die Strategy is and how it works in practice, it is good to understand how this can wrong. Yes, the strategy is a great tool for building wealth and it is the gold standard for tax planning. However, there are some risks you should consider before you begin.

Before you implement the strategy, you should have a really good understanding of the following risks:

1. Good debt vs. bad debt

There is good debt and there is bad debt. It is critical you understand the difference between the two. The strategy works with good debt. It does not work with bad debt.

2. Pay attention to interest rates

Interest rates are very important here. If rates are too high, the benefits you receive from not selling the asset and instead borrowing against it might be outweighed by the debt service payments.

Watch out for variable rates. You might start with a low rate but that can quickly change if rates increase. It will also likely be difficult to unwind and eliminate the debt without suffering a big tax bill if rates do get too high.

We saw this happen in 2022 when the Fed started aggressively raising rates. In some cases, rates charged on SBLOCs went from below 2% to higher than 5% or 6% in less than a few months.

That is not to say you can’t still use this approach in high interest rate environments. If you can afford the debt service payments, it might still be a good idea depending on how you are using the strategy and what benefits you are looking to realize.

3. Value the asset used as collateral conservatively

Don’t get greedy about the amount you are borrowing. Be conservative in your estimates and always leave yourself a cushion.

Be reasonable when you are valuing the asset you want to borrow against. Don’t look at your brokerage portfolio at a time when the market is at its highest point.

History has shown us there can be large dips in the market at any given time. If you estimate the amount of leverage available before a market drop, there is a good chance you will find yourself getting a margin call.

This also isn’t the time to ascribe a high valuation to your business or real estate.

4. Maintain cash flow for debt service

This one should be obvious, but make sure you have the cash flow available to pay the debt. If current payments are required, make conservative estimates in ensuring that you can access cash on hand to service the debt.

5. Be careful with borrowing against volatile assets

Small cap stocks (public companies with smaller market capitalization) are typically more volatile than larger companies. Borrowing against shares of Apple is very different than borrowing against shares of a smaller public company you’ve never heard of.

It might be more prudent to scale back the amount you borrow against small cap stocks.

Borrowing against cryptocurrency at all is probably not a good idea. Just don’t.

6. Have a plan for margin calls

If you are borrowing against public securities, you need to be prepared for what is called a margin call. You might be in for a big surprise when your brokerage firm reaches out asking you to deposit more collateral or risk an involuntary sale of some of your securities.

A margin call happens when the value of your portfolio drops below what is referred to as the maintenance margin. This is a common issue when the stock market declines in value. Understand what your maintenance margin is and be very careful to never get anywhere close to it (or have a good plan in place in case you do).

If you do have a margin call, there are a few options available to you:

- Deposit cash into the account;

- Transfer more securities into the account (to increase the value of the portfolio); or

- Sell securities.

If you don’t satisfy the margin call in time, the bank will start selling your securities for you.

7. You can lose it all, twice

This one should also be obvious but worth reiterating. When debt is involved, you can lose everything. When you use the Buy, Borrow, Die Strategy, you can lose everything twice in some cases.

If you have a loan against an asset, there is a chance the value of that asset could go to $0. If you spent the money you borrowed, that money is effectively also lost because it is gone.

If you invest the money you borrowed into another asset, that second asset could also decrease in value to $0. In either case, there is a risk you could be left paying off a loan with lost money.

If you are going to invest the same money more than once, do not invest in correlated assets. This will significantly increase the risk of getting yourself in trouble if there is a downturn in the market.

Winsmith Tax is not in the business of providing investment advice. Nothing contained in this article or on this website constitutes investment advice. We encourage you to educate yourself and work with qualified professionals and advisors before making any investment decisions.

Buy, Borrow, Die Tax Strategy Course

I get so many questions about the Buy, Borrow, Die tax strategy that I put together an entire course dedicated to teaching you how to use Buy, Borrow, Die to build wealth.

Sign up to take the course so you can learn about the best tax planning strategy nobody else is talking about.